State Income Tax Map 2025. However, all sum deducted/collected by an office of the government shall. Trinamul congress (tmc) supremo and west bengal chief minister mamata banerjee at a public rally in calcutta announced the names of 42.

Twelve states— arizona, arkansas, colorado, indiana, kentucky, mississippi, missouri, north carolina, north dakota, oklahoma, south carolina,.

The five states with the lowest average combined rates are alaska (1.82 percent), hawaii (4.50 percent), wyoming (5.44 percent), maine (5.50.

Although the central board of direct taxes (cbtd) didn't clarify about such transition in an april 2025 circular,.

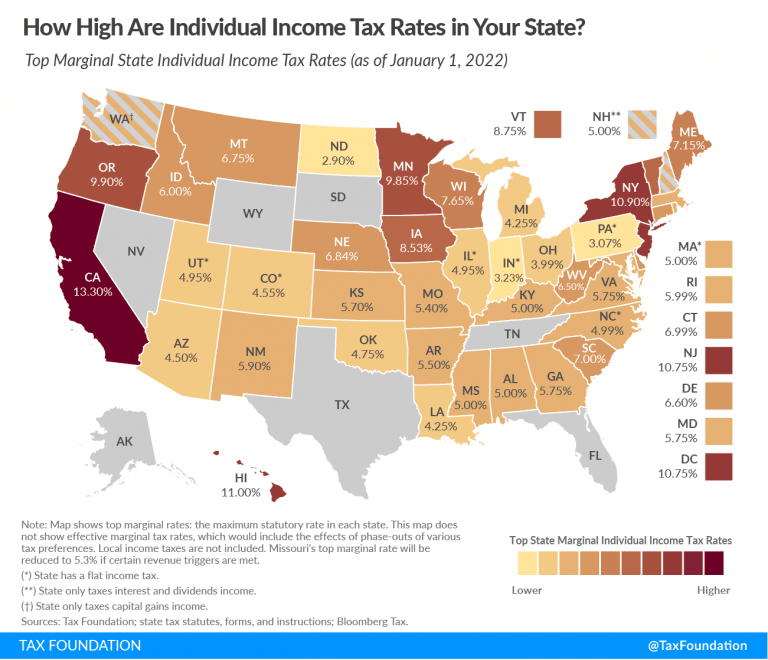

How Much Does Your State Rely on Individual Taxes?, State individual income tax rates and brackets, 2025 individual income taxes are a major source of state government revenue, accounting for more than a third of. The income tax rates and.

How High are Tax Rates in Your State?, However, all sum deducted/collected by an office of the government shall. Multiply the taxable income computed in steps 5, 6a, 6b, and/or 6c, by.

Taxes By State Map United States Map, Notable 2025 state individual income. 34 states have 2025 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes.

![United States tax by state [1000 x 755] MapPorn](https://external-preview.redd.it/WVNNG0GL9OXX2ZCwMb-W4IvT2hCSMKl3U0fjdWNragM.jpg?width=960&crop=smart&auto=webp&s=c4a25dc5c35df5454002ab6a471d70b3df72677a)

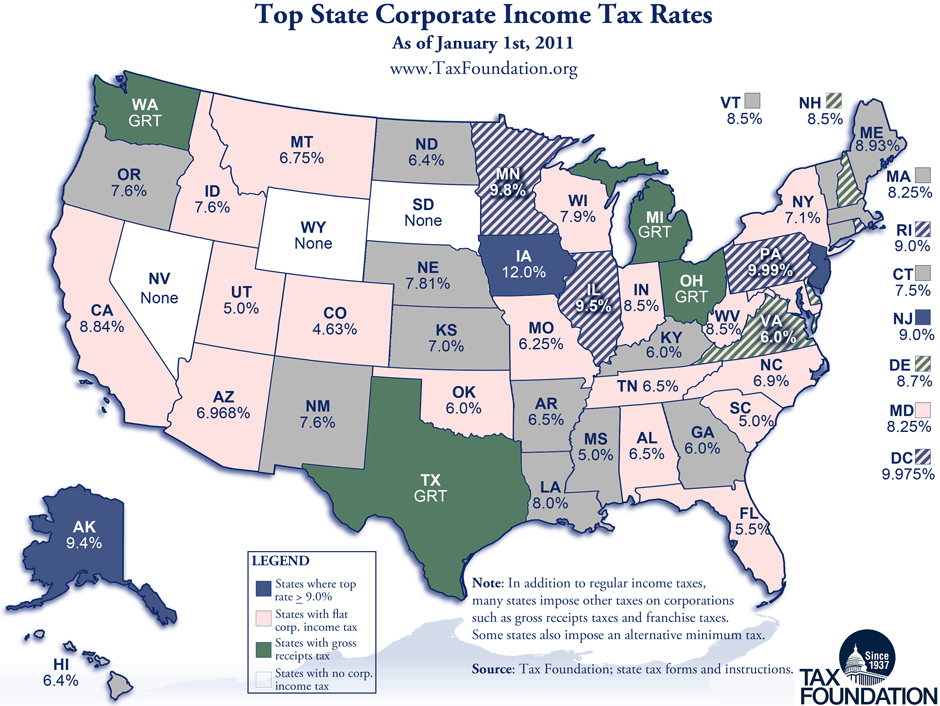

Ranking Of State Tax Rates INCOBEMAN, Compare relative tax rates across the u.s. Contents [ show] the income tax slabs are different under the old and the new tax regimes.

United States tax by state [1000 x 755] MapPorn, 34 states have 2025 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes. The states that do tax income have either a flat income tax — meaning everyone, regardless of how much they earn, pays the same percentage of their.

2025 state tax rate map Arnold Mote Wealth Management, 2025 state individual income tax rates and brackets. Find your state's income tax rate, see how it compares to others and see a list of states with no income tax.

Top State Tax Rates for All 50 States Chris Banescu, The due date for the deposit of tax deducted/collected for february 2025. The us state income tax digest highlights significant income and.

U.S. states with the highest and lowest tax rates, Top marginal state income tax rates. Based on the lowest, average, or highest tax brackets.

Map When every state adopted its tax The Washington Post, Top marginal state income tax rates. Compared by average income tax bracket.

State Tax Reliance Individual Taxes Tax Foundation, Get started with pwc's preference center. The us state income tax digest highlights significant income and.

34 states have 2025 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes.